How to file for ETAX

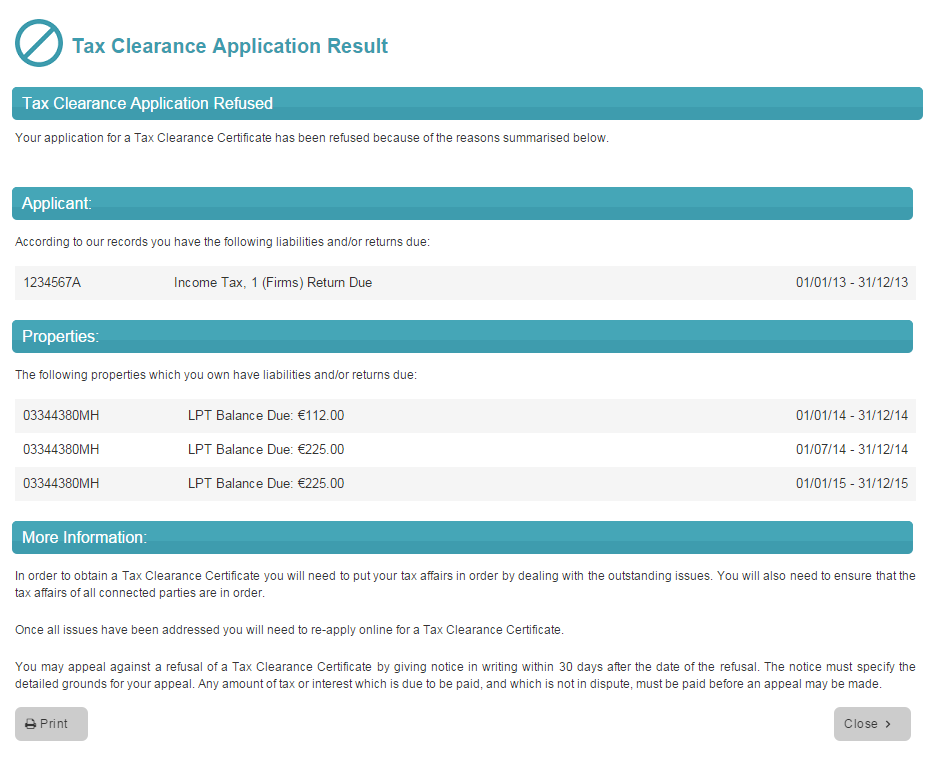

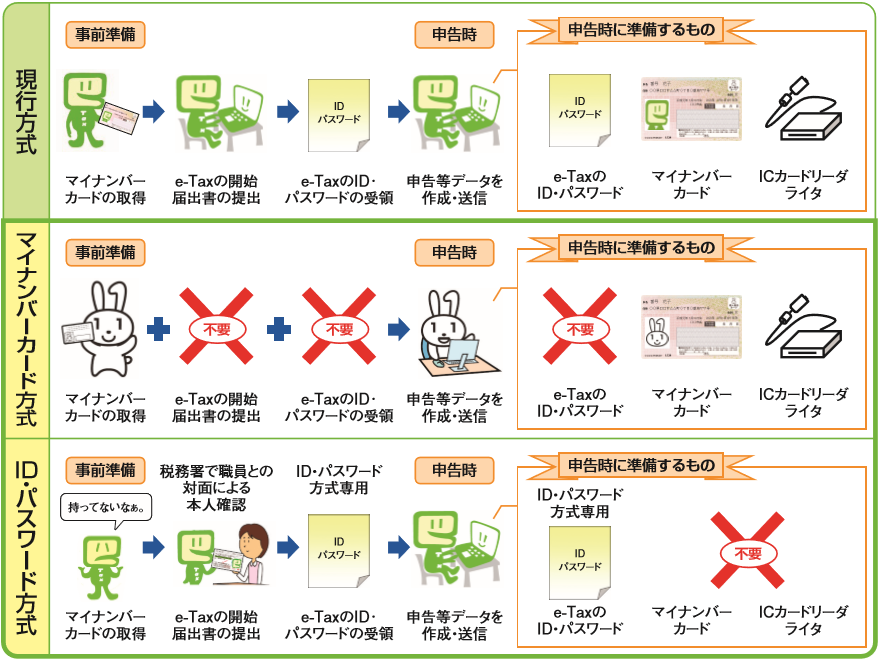

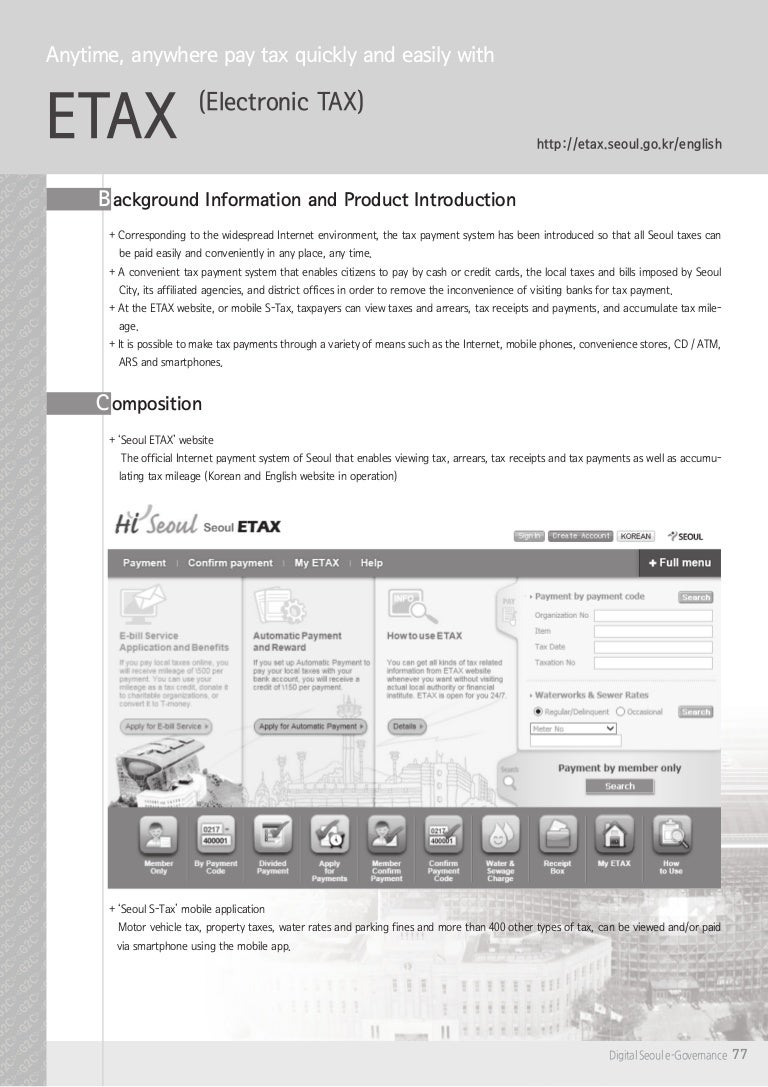

A secure environment• How to file in ETAX Individual Income Tax for income years prior to 2017• Tax Clearance• Notice of Assessment Identification any two of the following• e-Tax provides the following benefits:• BIR Number Verification any one of the following• Access your tax account information• e-Tax is safe, secure, easy, convenient, and free. Ensure your BIR number is included in the registration form. English lowercase letters a through z• Make sure to indicate to the Customer Service Representative that you are registering for e-Tax. VAT Advisory• Convenient and reliable service• These persons include tax practitioners or accountants. e-TAX Tags: , , , , Introduction e-Tax is the online portal provided by the Inland Revenue Division IRD for taxpayers to manage their tax accounts online. If you do not receive any such notification please send an email to info. Passport• English uppercase letters A through Z• Once completed and submitted, you should receive an email notification with additional registration details. Advice of BIR or Advice of BIR and Acct Numbers• View status of refund• This makes filing extremely easy as well as extremely fast. Go to• Log in• Complete and Submit the ttconnect ID Registration Form online. Enter the necessary information in the return• No postal delays• Contain characters from each of the following four 4 categories:• National Identification Card• Drivers Permit• Recent return figure• What are the Benefits of using e-Tax? e-Tax has features which would allow you to view tax balance, check refunds status and perform a wide variety of tasks. We ask you questions in language you can understand. Return tracking• The authorized person accessing e-Tax must know one of the following:• We guarantee that we get you a maximum federal tax refund by maximizing your credits and deductions. Electronically file tax returns• Statement of Tax Account• Confirmation or acknowledgement of filing the return• Activate your ttconnect ID instructions for activation are contained in the email notification. Easy way to file returns• Submit queries …. Potentially lower administrative costs• e-Tax gives the customers of the Inland Revenue Division online access to their tax accounts and related information. Faster processing times. By accessing e-Tax at in any standard web browser, taxpayers can register to view their accounts, file returns, and correspond with IRD. Electronic Birth Certificate• Retrieve tax balances• This password must meet the following criteria:• With our step-by-step questionnaire, you are asked only the questions which pertain to you. Recent payment amount and the account to which it was paid You will then be asked to create a password that will be used to gain access to that BIR number in e-Tax. Letter ID from a recent letter• Access 24 hours a day, 7 days a week• e-Tax allows you to authorize other persons to access your account. Numeric characters 0 through 9• Your First e-Tax Access The first time you use e-Tax, an extra validation will occur. Be at least eight 8 characters long• View Correspondence• View transactions for previously filed returns• To use e-Tax, you need to get your ttconnect ID Register for your ttconnect ID in three 3 simple steps: 1. Grant or remove access to your account• Naturalization Certificate Once you have a ttconnect ID, you can visit to begin using e-Tax! Register for a tax account• Non-alphanumeric characters for example!。 。 。

.JPG)